Join us for MemberPalooza!

From Oct. 1 - Dec. 31, we're celebrating our 87th anniversary, being named Best Credit Union in Orange County again by the OC Register, and YOU, our Members! From referral bonuses to special loan and deposit offers, now's the time to take advantage.

These limited time offers end soon - don't miss out!

Additional terms, conditions, and restrictions apply and are subject to change at any time. Ask an Associate for additional information.

1Referral Bonuses: The same $87 bonus will be paid to the referrer (existing Member) and referee (new Member). The “referrer” bonus is only available to existing Members of Orange County’s Credit Union who have checking accounts. The “referral” bonus is available to “new” Members only. A “new” Member is defined as a person who has never been an owner or signer of a checking or savings account or loan with Orange County’s Credit Union. Maximum 10 referral bonuses per calendar year. Bonus Payout: Referrer and referee bonuses will be paid out within 90 days after the referee opens the eligible checking account and meets all the eligibility requirements. Referral form must be presented at the time the new checking account is opened. Form must be completely filled out so we have adequate information to pay out the cash bonus to the friend who made the referral. Referrer and referee bonuses will be paid by deposit to respective checking accounts. The notation “Refer” will appear on the referrer’s statement. Referee bonus paid represents dividends deposited into your account and may be reported to the IRS. Any applicable taxes are the responsibility of the recipient. Eligibility: Referee must open an eligible personal checking account (Basic, Interest, Access, Plus or Pacific Checking), enroll in eStatements, sign up and qualify for a debit card (not all applicants will qualify), and set up and receive direct deposit within 60 days of account opening. Social Security can be used as a direct deposit for Basic, Interest, and Plus Checking accounts. The referee’s checking account must remain open and maintain eStatement preference for 90 days or referral bonus may be reversed. Offer only available at branch locations. Offer not available in conjunction with other offers. Individuals may not refer themselves for the referral bonus. All accounts are subject to normal approval standards. Minimum opening deposit is $25.00 for Checking accounts. Basic, Access, Plus, and Pacific Checking accounts do not earn dividends. Interest Checking: Annual Percentage Yield (APY) is 0.07% as of October 1, 2025 and are subject to change at any time. For current rates, visit orangecountyscu.org. Minimum balance to earn APY is $600. The rate and APY may change after account opening. Fees may reduce earnings on the account. Associates of Orange County’s Credit Union are not eligible for the referrer or referee bonuses. Membership requirements apply. Additional terms and conditions apply and are subject to change. Refer to the Account Agreement, Truth-In-Savings, and Electronic Funds Transfers Disclosure Agreement, and Schedule of Fees for additional information. Ask us for details. Limited-time: This limited-time promotion from October 1, 2025 to December 31, 2025. Notice to Credit Union Associates: Use promo code REFERAFRIEND.

2Rates, Annual Percentage Yield (APY), and terms are accurate as of October 1, 2025 and are subject to change at any time. Fees may reduce earnings on the account. APY is based on the assumption that certificate funds (including dividends) will remain in the account until maturity. There is a penalty for early withdrawal of certificate funds.

Minimum balance to open is $1,000. The Special Term Certificates are a promotional product and may change or end without notice. Special Term Certificates will automatically renew at the nearest lower standard term (at the then applicable offered rate), unless you instruct us otherwise (at the then applicable offered rate). The 8-Month Special Term Certificates will automatically renew into the 6-Month Term. New Money is defined as funds not currently on deposit with Orange County’s Credit Union. Transfers from existing Orange County’s Credit Union accounts do not qualify.

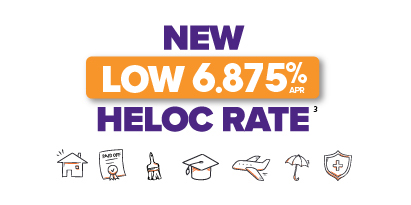

3APR = Annual Percentage Rate. This is not an offer for an extension of credit or a commitment to lend. All applications are subject to borrower and property underwriting approval. Not all applicants will qualify. Property must be located in California. Membership in Orange County’s Credit Union is a condition of loan approval. APR displayed includes a 0.25% interest rate discount for automatic payment from Orange County’s Credit Union checking account. If you elect not to have automatic payments from Orange County’s Credit Union checking account, your interest rate will be 0.25% higher. The rate may change quarterly. Rate cap of 12%. 10 years draw period followed by a 15-year amortized repayment period. Non-recurring closing costs are waived; as long as HELOC is kept open for at least 36 months. If closed before the end of 36 months, borrower must pay all third-party non-recurring closing costs. Non-recurring closing costs typically range between $769 and $1927. $50.00 Annual Fee after first year. Annual fee is waived for Platinum Members and is $25.00 for Premier Member. The minimum monthly HELOC payment is equal to 1 percent of the outstanding principal balance at the end of each statement cycle, with a minimum of $100.