Small Business Financing

Small Business Financing

Small Business Resources

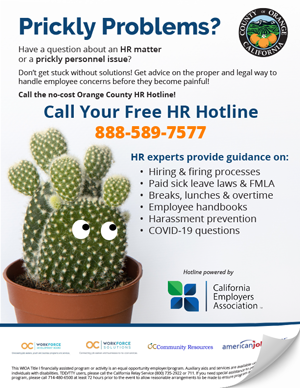

There are many free resources available for Orange County small businesses. As a guide, we’ve highlighted some valuable resources for you and your business.¹ In partnership with the County of Orange, we’re here to assist with all of your business needs including information on hiring and employee management as well as ways to grow your business.

We’ve also highlighted these useful websites that include additional free business resources:

Small Business Vehicle Loans

Keep your business going with commercial vehicle loans that are tailored to your needs.

What's Needed

Let us assist you with your next small business loan. Start by gathering the listed requirements.

Important Documents You'll Need |

Loan Qualification Reminders |

|

|

Submit your files and we'll get started with your loan request.

Important Documents You'll Need

- Credit Application

- Form 4506-C: IVES Request for Transcript of Tax Return

- Personal Financial Statement

- Business Debt Schedule

(.xlsx File Download)

Loan Qualification Reminders

- 750 Minimum FICO

- Two+ Years in Business

Submit your files and we'll get started with your loan request.

Meet Your Loan Consultants

|

Ben Newman Ben Newman is the Senior Commercial Real Estate Loan Officer at Orange County’s Credit Union. Having started his banking and finance career while still attending university and quickly becoming a licensed loan officer in 2004, Ben soon learned that he had the aptitude and passion to navigate the unique Southern California commercial real estate market. Fast forward two decades and Ben has completed over $1 billion in loan transactions, refined his keen insight into the nuances of commercial loan timing and structure, and become a trusted professional known to maximize client savings, convenience, and, ultimately, client satisfaction. His clientele ranges from high-net-worth individuals and influential property owners/developers, to family teams and first-time investors. Arranging multifamily, industrial, retail, office, and self-storage loans, among others, has given Ben the perspective and experience to bring those he serves significant savings and investment profitability. Having experienced Ben’s signature service and personal touch, his clients return time and time again, with many having expanded their portfolios to include additional revenue sources such as construction financing, bridge loans, and permanent loans. Ben is proud to be an Anteater, having attended his hometown University of California Irvine on an academic scholarship and graduating in 2007 with his Bachelor of Science degree in Criminology, Law, and Society. When he is not delivering excellent service and value to his Credit Union clients, you can find Ben fishing with his son, watching an action film with his wife, or regularly volunteering at any number of financial literacy events for at-risk youth. |

Jon Hosea Jon W. Hosea joins the Credit Union with an extensive background in real estate finance, having key experience in credit analysis, originations, loan workouts, mortgage loan participation/syndications, bulk loan sales, and management of geographically centralized and non-centralized groups. Throughout his lending career spanning over 40 years, Jon has demonstrated his unwavering ability to manage and resolve complex problems to bring clients to successful outcomes. Hosea holds a B.A. in Business Administration with a concentration in Economics from California State University, Fullerton, where he also became a member of Omicron Delta Epsilon, a national economics honor society. When he’s not at work, Hosea enjoys spending time with his wife of 49 years, his children, grandchildren, and extended family. He also has a strong affinity for playing USTA tennis and restoring “Modern Classic Cars” as an active member of local car clubs. |

Ben Newman

Senior Commercial Real Estate Loan Officer

(714) 755-5900 ext. 7436

bnewman@orangecountyscu.org

Ben Newman is the Senior Commercial Real Estate Loan Officer at Orange County’s Credit Union. Having started his banking and finance career while still attending university and quickly becoming a licensed loan officer in 2004, Ben soon learned that he had the aptitude and passion to navigate the unique Southern California commercial real estate market. Fast forward two decades and Ben has completed over $1 billion in loan transactions, refined his keen insight into the nuances of commercial loan timing and structure, and become a trusted professional known to maximize client savings, convenience, and, ultimately, client satisfaction.

His clientele ranges from high-net-worth individuals and influential property owners/developers, to family teams and first-time investors. Arranging multifamily, industrial, retail, office, and self-storage loans, among others, has given Ben the perspective and experience to bring those he serves significant savings and investment profitability. Having experienced Ben’s signature service and personal touch, his clients return time and time again, with many having expanded their portfolios to include additional revenue sources such as construction financing, bridge loans, and permanent loans.

Ben is proud to be an Anteater, having attended his hometown University of California Irvine on an academic scholarship and graduating in 2007 with his Bachelor of Science degree in Criminology, Law, and Society. When he is not delivering excellent service and value to his Credit Union clients, you can find Ben fishing with his son, watching an action film with his wife, or regularly volunteering at any number of financial literacy events for at-risk youth.

Jon Hosea

Commercial Real Estate Loan Officer

(714) 755-5900 ext. 3300

jhosea@orangecountyscu.org

Jon W. Hosea joins the Credit Union with an extensive background in real estate finance, having key experience in credit analysis, originations, loan workouts, mortgage loan participation/syndications, bulk loan sales, and management of geographically centralized and non-centralized groups. Throughout his lending career spanning over 40 years, Jon has demonstrated his unwavering ability to manage and resolve complex problems to bring clients to successful outcomes.

Hosea holds a B.A. in Business Administration with a concentration in Economics from California State University, Fullerton, where he also became a member of Omicron Delta Epsilon, a national economics honor society. When he’s not at work, Hosea enjoys spending time with his wife of 49 years, his children, grandchildren, and extended family. He also has a strong affinity for playing USTA tennis and restoring “Modern Classic Cars” as an active member of local car clubs.

View Our Full Commercial Services Offering

Business Banking Products |

|

» |

Business Checking |

» |

Business Savings |

» |

Business Money Market |

» |

Business CD's |

Business Loan Products |

|

» |

Business Vehicle Loans |

|

|

|

|

|

|

|

|

|

Commercial Real Estate |

|

» |

Commercial Real Estate Financing |

» |

Multifamily Real Estate Financing |

|

|

|

|

|

|

Business Banking Products |

|

» |

Business Checking |

» |

Business Savings |

» |

Business Money Market |

» |

Business CD's |

Business Loan Products |

|

» |

Business Vehicle Loans |

|

|

|

|

|

|

|

|

|

Commercial Real Estate |

|

» |

Commercial Real Estate Financing |

» |

Multifamily Real Estate Financing |

|

|

|

|

|

|

¹Orange County’s Credit Union provides links and access to third party websites or services that contain information that is provided as a service to those interested in the information. Orange County’s Credit Union neither regularly monitors nor assume liability for the content of third parties’ statements or websites; does not endorse or adopt those websites, or any information contained on such websites; and does not make any representations or warranties whatsoever regarding the accuracy or completeness of the information provided on or obtainable through those websites. Information contained on the highlighted websites and the resources available for download through those websites are not intended as, and shall not be understood or construed as legal, financial, tax, medical, health, or any other professional advice and will not serve as the primary basis for any decision made by you. The views, opinions and advice obtained on or through any of the highlighted websites reflect those of the individual authors and are not endorsed by Orange County’s Credit Union. The resources highlighted are designed for and intended for use by adults. If you are under 18, you may not access the highlighted websites without the involvement of a parent or guardian. If you are a parent or legal guardian, you must monitor and supervise the use of the highlighted websites by children, minors and others under your care.